These stats show just how FloQast can help finance teams close their books faster and eliminate risk, improving overall confidence across the organization.

From automated reconciliations to advanced workflow visibility, TydeCo trusts FloQast to equip your finance team with real operational control.

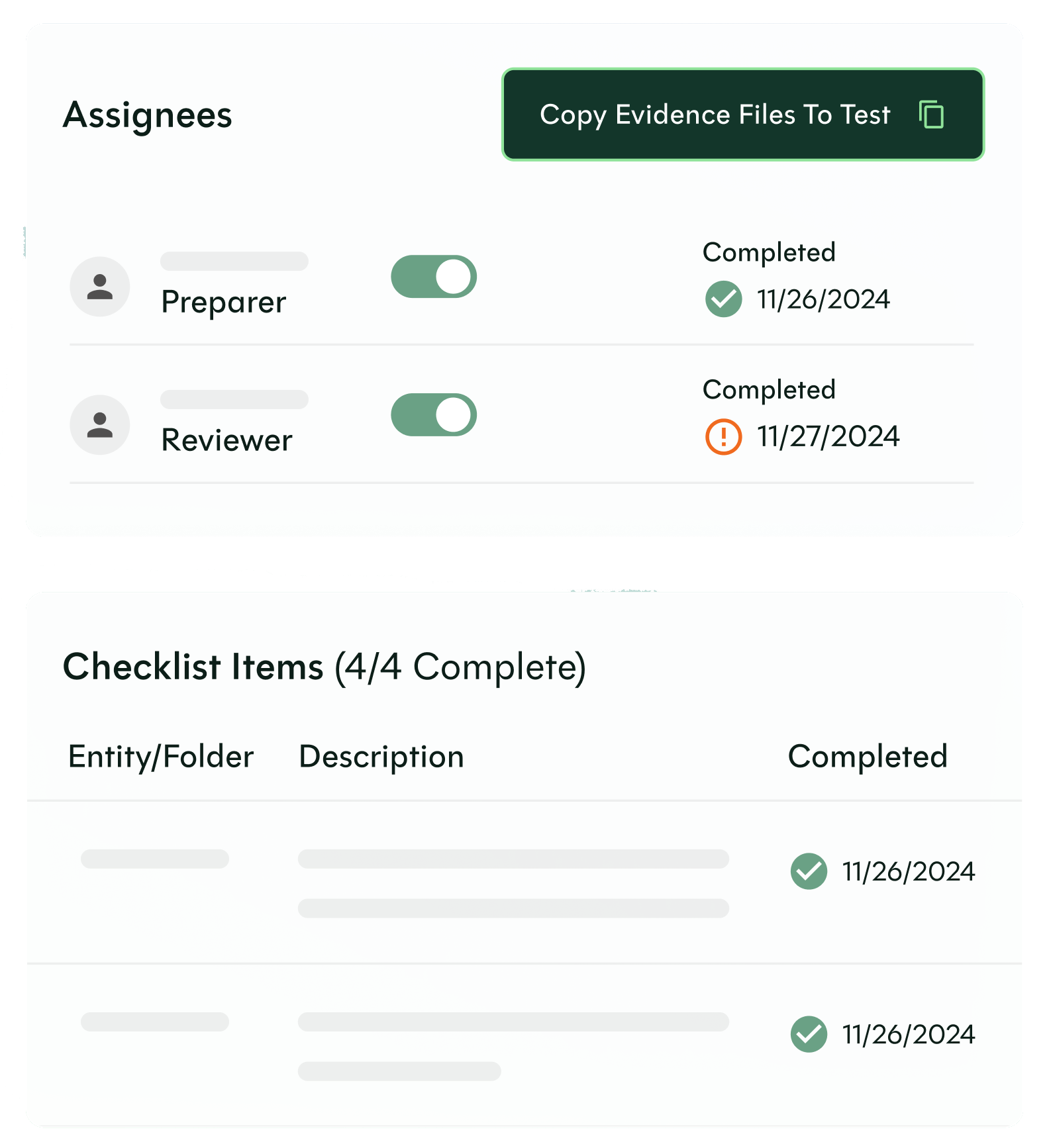

Centralize and streamline your close process with task assigning and deadline automation, along with full visibility across your finance team.

Reduce the manual workload with automated reconciliations that pull data directly from your ERP, making it easy to detect discrepancies early.

Maintain an always-ready audit trail with real-time documentation, workflow logs, and version histories built directly into your close tasks.

Keep everyone perfectly aligned with automated reminders and shared templates, providing a single source of truth for all close-related activities.

Use standardized close checklists that ensure nothing falls through the cracks, while allowing for easy customization as your needs evolve.

Get better visibility into team performance, bottlenecks, and task completion metrics so that you can optimize financial processes and demonstrate actual progress.

FloQast integrates natively with Sage Intacct and other leading ERPs, pulling GL balances directly to reduce data entry errors and time wastage.

Unlock additional value with extended software tools and add-ons designed to deepen insight and streamline controls while also scaling effortlessly.

Before FloQast, Centogene juggled spreadsheets and email. Now, close and compliance live in one transparent, easy-to-use system.

We wanted one tool for our timetable, documentation flow, and a shared solution for auditors. With FloQast, we finally found it. It connects close management and SOX compliance in one place, which makes everything visible and easy to understand. Having one source of truth reduces effort and brings transparency across teams.

FloQast is designed for finance teams that want structure without sacrificing flexibility—especially during the month-end close.

See how FloQast helps controllers and CFOs streamline close, improve accuracy, and gain visibility in real time.

We’re proud to support the teams behind these logos. Long-term partnerships built on trust, capability, and results that hold up.

FloQast is a strong fit for teams in fast-moving industries where financial controls, approvals, and audit timelines matter. TydeCo™ supports implementation and scale.

Explore our latest thinking on financial systems, reporting strategy, and digital transformation—tailored to the industries and tools we support.

Just getting started or fine-tuning your setup?

Here are a few questions that often come up along the way.

Perhaps the biggest benefit is the 38% reduction in reconciliation time. This is due to automated matching and clear task ownership, which provides sufficient momentum to keep accounts moving. It’s also worth noting that adopting FloQast can save your business 27 hours per month.

Another area that experiences significant time savings is audit prep. All of the data required (evidence, approvals, logs) are in one place, making it very easy for auditors to follow the trail.

Productivity, especially in close cycles, improves thanks to checklists, reminders, and status views to keep people on schedule, as well as on the same page. Task ownership helps improve focus, so the right people for the job are doing the job.

Visibility into accounts is also improved, giving leaders the opportunity to identify and address bottlenecks as they occur during the close. There’s no need to wait for the end of the month to take delayed action.

Standardized checklists improve monthly close by laying out the sequence, owners, and deadlines for every recurring task. Automated reminders also ensure everyone knows what’s expected of them and when they need to deliver.

Shared templates ensure all parties work from the same source information in real-time. There are none of the delays that typically result when communication and information sharing relies on emails and chats. In fact, using one shared workspace that shows task status, late items, and blockers keeps review meetings shorter, sharper, and more impactful.

Access to source information reduces the need for team members and stakeholders to send one another files or screenshots because it’s all right there for everyone to see.

Integrating with ERP ensures all balances are current. This means all data is live (real-time updates) and accessible, so there’s no need to make do with extracts of information from here and there.

Automation; who doesn’t love it? In FloQast, automated reconciliations save time and increase accuracy by pulling GL balances and flagging variances early. The result is predictable data that holds no nasty surprises come month end.

AutoRec automates reconciliations. When used with matching rules they reduce repetitive tie outs across accounts from spreadsheets and other outdated, inefficient finance-related legacy systems. Variance and flux analysis reveal unusual movements in accounts, which triggers investigations more quickly and shines light on the narrative.

Automation also features in compliance where it tracks control steps, approvals, and exceptions as work happens, and not after when it’s often too late to do anything constructive about it.

Then there’s entity consolidation support, which removes offline eliminations and does away with manual roll ups.

As you can see, automation saves the day in many different aspects of accounting and financial management.

FloQast updates documentation in real-time and records version histories for each task and reconciliation. Data is always current and audit ready and there’s a clear audit trail to verify data and actions taken.

Workflow logs record actions taken, attributing them to the person carrying out the task, as well as exactly when it was carried out. Auditors are grateful because walkthroughs are faster and cleaner.

All of these logs and records provide evidence accompanying the control step. The benefit is a major reduction in audit sampling going back and forth between the taxman and various interlinked departments and department leaders, including finance, payroll, and HR.

Committees and external reviewers can access reports that reveal completion rates and exceptions. Meanwhile, the people that really count, the ones that put the data to practical use in all their tasks to ensure accuracy, timeliness, and efficiency, report fewer audit discrepancies after moving to structured, in-system workflows.

Collaboration keeps workflow running smoothly, improving efficiency and productivity. In financial services, collaboration has quite an impact on monthly close. For instance, role-based ownership ensures preparers and reviewers have clear due dates for tasks.

Teams work in shared templates, aligning and standardizing formats across entities and business units. This makes it easier for all parties and stakeholders to see and understand data. Dashboards deliver similar visibility as they provide a bird’s eye view of your company’s financial status and blockers.

Visibility and its neighbor, transparency, enable leaders to track and reassign work when there are bottlenecks, spikes in volume (seasonal peaks), or someone leaves the company and the remaining team members must pick up the slack.

FloQast places comments and notes in context, so all questions and responses are resolved for all to see. This eliminates long, separate threads for each question or matter raised.

Sage Intacct is usually recommended as the first native integration with FloQast. One of the benefits you’ll notice almost immediately is how GL balances and reports are automatically introduced into reconciliations.

In fact, automation enhances integration with leading ERPs because it automatically syncs data without manually exporting spreadsheets and data from other legacy systems.

Optional add-ons are often available as single modules for specific requirements and outcomes. For instance, flux analysis and compliance include scalability so system capability expands alongside your business for ongoing support.

Don’t underestimate the importance of analysis, but more than that, don’t underestimate how important it is for leaders to understand analysis. FloQast shares KPIs and task metrics upstream with leadership, including heads of relevant departments and the C-suite.

Now, some of these stakeholders only have a passing knowledge of finance, bookkeeping, and accounting. As a result, data is presented in easy-to-understand reports.