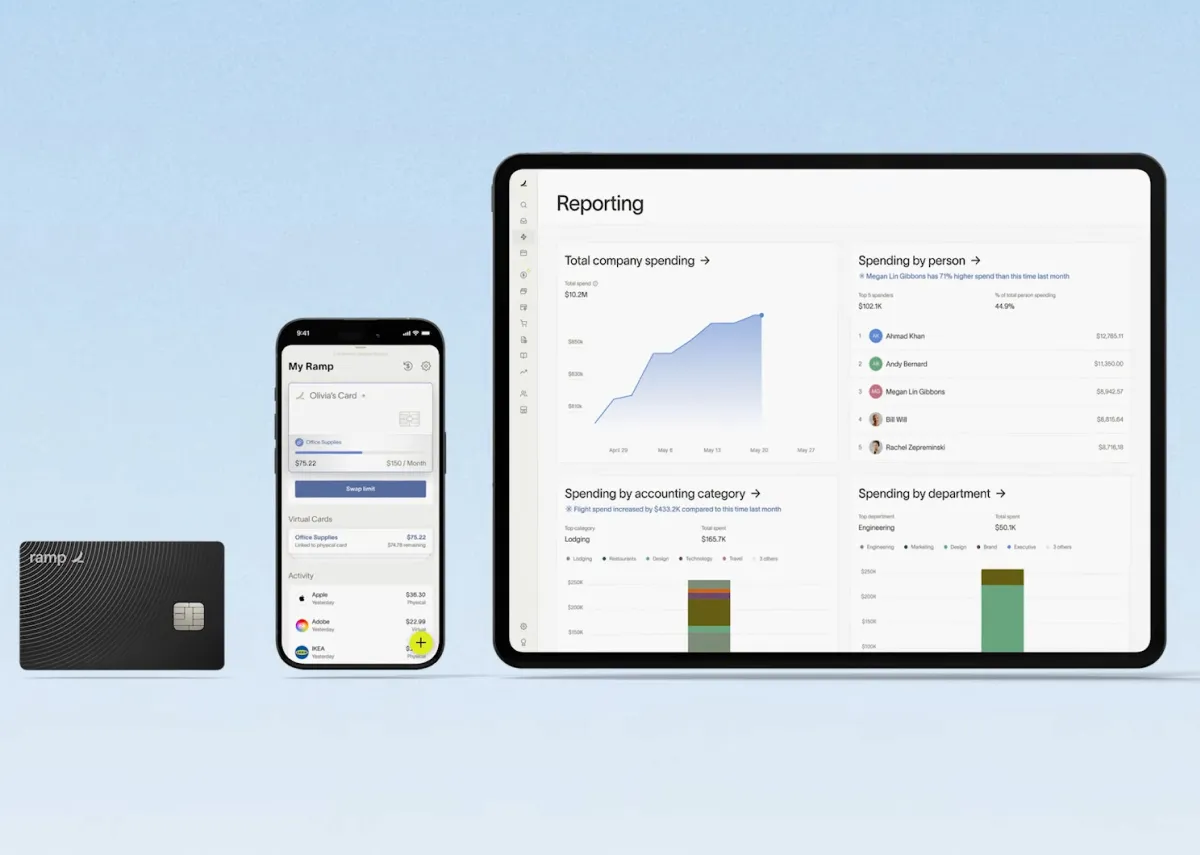

The real-world numbers, from numerous businesses, show just how Ramp can save you time and reduce costs, while also improving the overall visibility of your finance team.

Ramp offers your business efficient, built-in tools for managing company cards, bills, and approvals, all in one place.

Issue unlimited virtual and physical cards with merchant and category restrictions, and earn 1.5% cash back automatically on all spending.

Eliminate manual reporting by giving employees freedom to upload receipts via mobile, and allowing Ramp to match, categorize, and post transactions.

Upload vendor invoices, set approvals, and pay by ACH or check as Ramp syncs each transaction to your specific accounting software.

With TydeCo™ knowhow, Ramp seamlessly connects to Sage Intacct, allowing transactions, categories, and receipts to flow directly into your general ledger.

Custom alerts instantly notify your finance managers of any policy breaches, duplicate subscriptions, or overspending, before month-end.

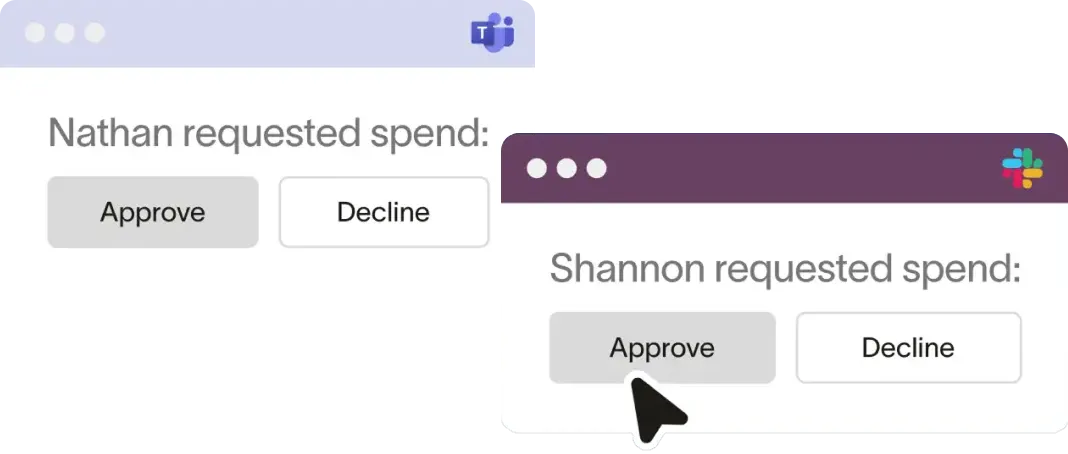

With built-in approval workflows, enable your staff to easily book flights or submit purchase requests directly within Ramp.

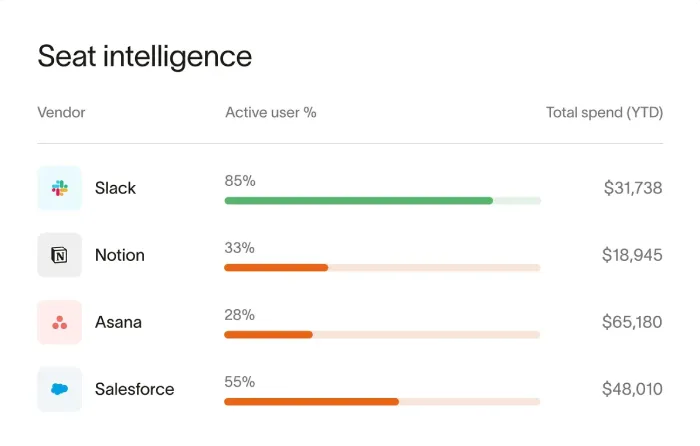

Ramp can intuitively highlight duplicate vendors and thus offer lower-cost alternatives, helping teams to save proactively rather than reactively.

With Ramp, TydeCo™ helps companies readily implement advanced workflows that can simplify their finance operations and enforce accountability.

Ramp made it easy for Webflow to scale its remote-first team, automate spend controls, and onboard globally in one day.

Ramp has saved us 75% of our time on credit card reconciliation. It’s intuitive, easy to onboard, and gives us visibility and control—even as a global, remote-first team. It’s one of those key tools that makes new employees feel like they belong from day one.

Xero appeals to service-focused businesses that value clean design, remote collaboration, and smart accounting foundations.

See how Ramp automates spend, procurement, and accounting, helping finance teams move faster and work smarter.

We’re proud to support the teams behind these logos. Long-term partnerships built on trust, capability, and results that hold up.

Ramp works best in industries where real-time spend visibility and control across departments and cards is a daily need. TydeCo™ supports smarter setup and oversight.

Explore our latest thinking on financial systems, reporting strategy, and digital transformation—tailored to the industries and tools we support.

Just getting started or fine-tuning your setup?

Here are a few questions that often come up along the way.

Ramp is a comprehensive AP tool that includes corporate cards, expense tracking, and bill payments in one platform. There’s no need to struggle with spreadsheets and manual reconciliations and expense reports. Ramp focuses on automation and provides real-time expense data, so you can catch overspending immediately.

Ramp is quick and easy to set up, with the typical turnaround time being 4-6 weeks. We manage the full implementation process, including accounting integration, card policy setup, and workflow configuration. What’s more, we provide team training and ensure that there is virtually no disruption to your finance operations.

Yes. Ramp integrates with Sage Intacct and QuickBooks Online. It automatically syncs expenses and card transactions to your general ledger. Reconciliation and financial reporting are automated and streamlined. It’s our job to ensure accurate mapping to General Ledger codes and vendor records. Automation reduces manual entries and increases accuracy.

We are a certified Ramp Professional Services Partner, implementing Ramp for clients who use QuickBooks or Intacct. Not only do we manage setup, integrations, approval policies, and team training, but we also provide post-launch support and optimization. We’re there at the beginning, ensuring that your finance system is correctly configured and efficient from the get-go.

Ramp delivers some pretty impressive results. Let’s start with over 40 hours saved per month as automation in reporting and matching replaces old manual systems. Don’t take our word for it. Consider a case study that looks at real life results for one of our clients, Webflow. Webflow reported 75% less time spent on card reconciliations, as well as faster month-end close.

Ramp users also benefit from a 5% reduction in spend thanks to intuitive controls, insights, and real-time alerts. Savings result from eliminating duplicate costs and identifying unnecessary or wasted expenses.

Enjoy improved efficiency as a single central system consolidates cards, spend controls, approvals, and accounting into one platform. This replaces a mess of multiple disconnected finance tools.

Ramp also supports global ready workflows for international operations and facilitates quick onboarding for new staff. This saves time and improves productivity as they can assume their roles fully with less palaver.

Ramp has some nifty solutions to control excess spending on cards and expenses in general. First off, you enjoy unlimited virtual and physical cards with merchant and category limits. And, you automatically earn 1.5% cash back on all spending.

Mobile accessibility and automation enable you to capture receipts on mobile devices, with automatic matching and posting, which saves time and increases efficiency. Efficiency is further enhanced and costs reduced with insights that flag duplicate vendors and unused subscriptions.

Access to data is limited by role-based permissions, which can be set by entity and department. Limited authorization ensures the safety and integrity of sensitive financial data.

You can also set up real-time policy alerts so you’re properly prepared for the month-end. Timely alerts also prevent out of policy charges.

Ramp’s system enables you to upload vendor invoices and set route approvals by threshold and policy. You can pay by check or direct ACH transfer between banks from one central workspace.

All transactions are synced to your accounting software , so there is less duplicate data. In fact, data sharing is enhanced, while your status remains visible, preventing accidental overspending and maverick spending.

Another benefit from using Ramp software is the availability of three-way invoice matching for POs, invoices, and receipts. This is important as it effectively triple checks accuracy before you make any payments.

Finally, logs and documents are stored, with evidence, at each step. This ensures your books are always audit-ready and available to leaders, board members, other stakeholders, and, of course, the taxman.

We provide native integrations to Sage Intacct, NetSuite, and QuickBooks. The product you choose will depend on your current needs and plans for future growth. Your consultant will work with you to guide your decision.

Integration and automation ensure that categories, receipts, and transactions flow straight to the GL. In terms of efficiency, this is a significant step up from old legacy systems, clunky spreadsheets, and manual exports.

It’s worth noting that Ramp supports multi-entity structures, ensuring that consolidated views remain aligned, even during international expansion. Smoother workflows, with fewer manual entries and fixes, ensures month-end processes (and figures) are cleaner and clearer for accurate insights into your immediate financial wellbeing.

Analytics also provide insights based on KPIs and task metrics, providing leadership with the information they need to make crucial decisions that affect financial wellness and growth.

Ramp comes equipped with built-in approval workflows that make it easy to book flights or submit purchase requests directly in the system. This means that travel and purchase requests are captured with policy rules and approvals.

In fact, the system includes AI-supported request capture for speed, efficiency, accuracy, and consistency. What’s more, policy violations are detected in real-time, so you can stop transactions before they happen.

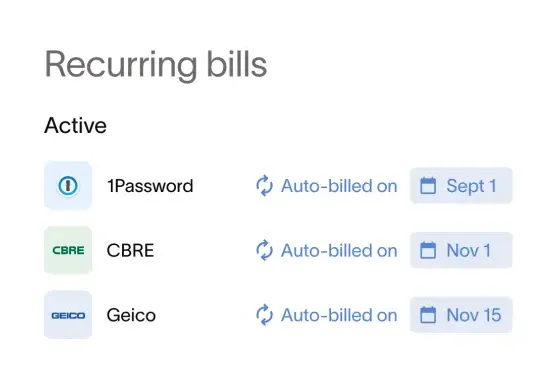

Vendor management is part and parcel of the product, complete with renewal dates and pricing-related data to support informed decision-making. Tracking spend by vendor can provide the type of in-depth insights that enable you to take tighter control over procurement-related spending, should it be necessary.

Another big benefit is real-time visibility, which enables leaders and managers to evaluate requests before the transactions hit the ledger. This ensures you know what’s potting procurement-wise and gives you tighter control over travel requests and spending.

We provide a range of services to support and enhance your Ramp experience. We consider collaboration to be one of our most important business offerings. This means we work closely with all our clients to ensure we get the right system design and implementation plan to suit their company’s unique needs and circumstances, especially when it comes to policy, limits, and workflows.

Integration and automation across ERP and HR systems improves efficiency and productivity through data sharing and real-time updates.

We also provide a range of outsourced financial services for companies with varying needs and capabilities. You can outsource your bookkeeping and trust that it will remain aligned to close cadence and controls. Your outsourced controller services take care of reconciliations and compliance requirements.

You can carry on with the business of doing business while we fine tune alerts, limits, and approvals as your team evolves and spending capacity changes.